For Accounting Professionals

Accounting Professionals will Reduce Costs & Increase Efficiency

For accounting professionals, AR automation can automate the everyday tasks of their profession. This automation enables them to dedicate more time to other priorities.

AR automation also provides outside accountants, their clients, or in-house accounting professionals with an easier way to maintain records and provide accurate reports in a timely manner. Technology streamlines data entry, processing, collection management and reconciliation processes, making it simpler for accounting professionals to prepare financial statements accurately and quickly.

Features Accounting Professionals Need

By reducing manual labor involved in billing and accounting tasks, eliminating errors through automated data entry, and enabling scalability as the business expands, AR automation is essential for accounting professionals aiming to enhance efficiency while maintaining accuracy in their work.

Improved User Interface

Increase productivity due to an enhanced user interface compared to traditional accounting systems.

![]()

Smart Automations

Save time and improve accuracy with an automated collections system, payment reminders, and smart invoices.

![]()

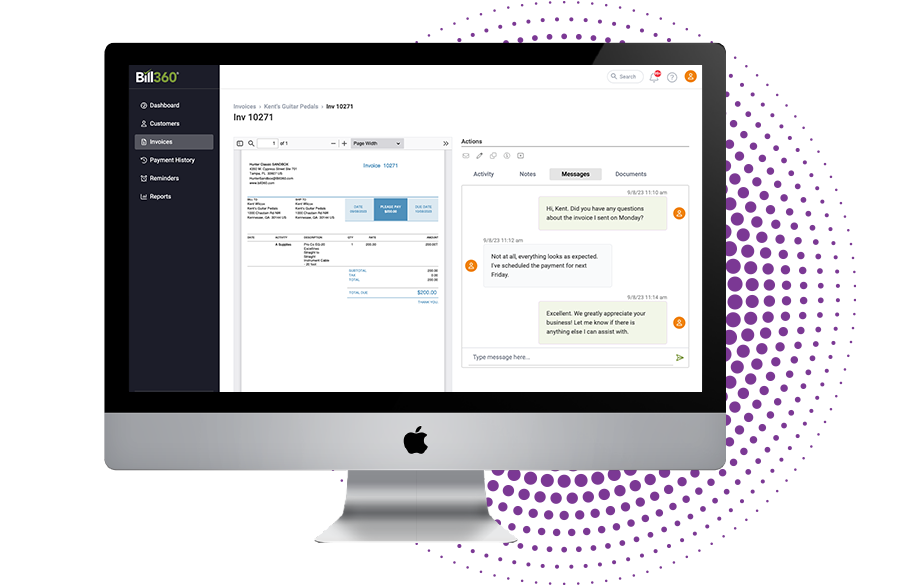

Collaborate with Customers

Our tools empower your team to resolve customer issues while minimizing disruptions to your business operations.

![]()

Accelerate Your Cash Flow

Streamline your AR processes to reduce expenses, improve on-time payments, and enhance your cash flow.

![]()

Remarkable Scalability

As your business grows, the flexibility of automation allows you to take on more customers and maximize your profits.

![]()

Seamless Payments

Handle transactions via an embedded platform for ACH and card processing — no third-party payment processors with Bill360.

![]()

Here's Why You Need Bill360 —

even if you're using QuickBooks or Xero

|

QBO | QBD | QBE | Xero | |

| Seamless Embedded Payments Built for B2B | |||||

| DSO Monitoring via Dashboard | |||||

| Supplier Portal Focused on AR Automation | |||||

| Buyer Portal with Invoice History | |||||

| AutoPay Option for Buyers | |||||

| Secure Buyer-Managed Payment Wallet | |||||

| Real-time Customer Collaboration | |||||

| Deposit Settlement Capabilities | |||||

| Fully-integrated Payments and AR Support | |||||

| Supplier/Buyer Network Across Multiple Accounting Systems | |||||

| Unlimited Users | |||||

| Live Guided Setup |

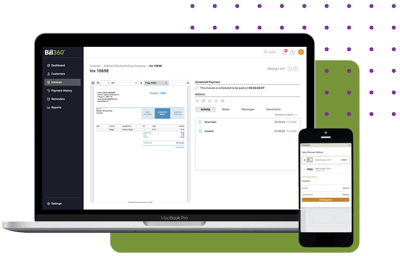

Supercharge Your Accounting System

![]() Bill360 doesn’t replace your existing accounting system. We simply pick up where it leaves off by adding critical functionality and features that save time, improve cash flow, and allow you to run your business more effectively. And Bill360 needs fewer than 30 minutes to sync with programs like QuickBooks and Xero, so you’ll be cutting costs and increasing profit in no time.

Bill360 doesn’t replace your existing accounting system. We simply pick up where it leaves off by adding critical functionality and features that save time, improve cash flow, and allow you to run your business more effectively. And Bill360 needs fewer than 30 minutes to sync with programs like QuickBooks and Xero, so you’ll be cutting costs and increasing profit in no time.

Take advantage of our 30-day free trial and discover why no one does AR (Accounts Receivable) automation like Bill360, purpose-built for B2B companies like yours.

A marketing agency was looking to improve cash flow and make its accounting team run with more efficiency. The agency chose Bill360 for AR automation and reduced aging receivables by 50%, transaction processing costs by 30%, and DSO by 88%.

Try Our ROI Calculator

Discover how much you could save by reducing your DSO and improving your productivity with Bill360's AR automation.

Bill360

From invoice to payment and everything in between

- Create, Send & Track Unlimited Invoices

- Unlimited Number of Users

- Embedded Payment Processing

- Set-It-And-Go Reminders

- Collections Automation

- Secure Customer Portal

- Reporting & Business Insights

- Full Accounting Integration

Bill360 Was Made for Accounting Professionals, Like You!

Take your accounting system to the next level. Bill360 is the only AR automation platform with data-enhanced embedded payments built for our B2B market. What's more, we are the only provider that has embedded payments for both ACH and card processing, giving your customers a truly seamless experience — just like Amazon® and Uber® have done for consumers!

See for yourself how we solve the AR issues affecting small-to-medium-sized businesses.