Credit Card Surcharging Guide

Credit card surcharging can reduce costs by sharing processing fees with your customers when they pay with credit cards.

If you choose to surcharge, it is essential you do so in full compliance with rules and regulations. Failure to do so may result in costly fines, termination from card networks, and damage to your company's reputation.

We encourage you to review Visa's®, Mastercard's®, and the other card brand's rules.

Surcharging FAQs:

Surcharging lets companies share the cost of accepting credit cards with their customers. There are strict rules set and enforced by the card networks, state laws, and federal regulatory agencies.

Not every state allows surcharging, so you must know where it’s prohibited and where it’s permitted. It’s a good idea to check with the State Attorney’s office or your legal council.

Your payment processor and relevant card networks need to be notified prior to surcharging.

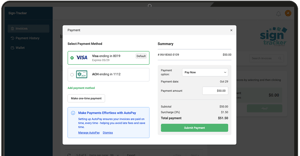

If you're using Bill360, we pre-register you with all necessary parties so you have one less thing to worry about.

In any Merchant Agreement, you agree to follow the complex rules set and enforced by the card networks, state laws, and federal regulatory agencies. Non-compliance can bring serious consequences including fines, frequent chargebacks, legal exposure, reputational damage, and payments blacklisting.

Unlike a surcharge, a convenience fee is a flat charge typically for using a non-standard payment channel.

Rules, regulations, and laws are created and enforced by the card networks, individual states, and federal departments.

Surcharging legality can be based both on the merchant (seller) and cardholder (buyer) locations.

Offer other payment options, such as ACH, so your customers can choose the options best for them.

Rules vary across card networks, state laws, and federal regulations, and all must be followed simultaneously. Rates, card type eligibility, disclosure requirements, and even legality can change based on the buyer’s location or seller’s location, and the issuing bank. Compliance for credit card surcharging is nearly impossible without automation.

How Bill360 helps.

We work with you to deploy a low-friction, high-return automated compliant surcharging strategy. Our certified solution was built to help B2B companies automate their surcharging process.

Compliant Software

Transparent Pricing

Immediate Value

Better Communication

Dedicated Support

Penalties for incorrect surcharging.

If your customers feel deceived by poor surcharging practices, the damage can extend well beyond that one relationship. The potential backlash could hurt your reputation online, in reviews, and in the industry.

The Merchant Alert to Control High-Risk (MATCH) list alerts banks to companies that have a history of non-compliant payment practices. Once a business has been placed on the MATCH list it is very difficult to accept payments.

Maximize margin, minimize risk.

Let us help automate your surcharging process so you can scale with confidence.

This is not legal advice; contact your lawyer for additional guidance. Surcharging compliance is complex. Bill360's Surcharging Functionality must be used in a compliant manner. For further restrictions and guidance on how to use our Surcharging Functionality in a fully-compliant manner, please review the applicable rules and regulations of Visa®, MasterCard® and the other payment brands.

* Subject to seller and buyer location, card networks rules, state laws, and federal oversight.