Become a Bill360 accounting partner.

Your clients need a smarter, fully digital accounts receivable (AR) solution. Partner with Bill360 so they can get paid an average of 36% faster and enhance their customers' experience-all while growing your business.

Complete the form to apply today.

Partnering has its perks for you, your clients, and their customers.

Generate ongoing payments revenue by offering secure AR automation and payment processing.

Boost satisfaction with a self-service portal that makes tracking invoices, payments, and invoice-level communications easy.

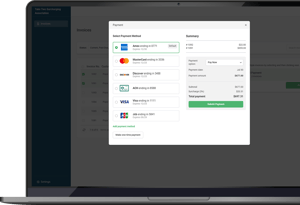

Securely tailor preferred payment methods with a digital wallet, set limits, and AutoPay.

Centralize messaging for specific invoices, include documentation and images, and set up automated alerts.

Hear what our users are saying

Watch how Bill360 has streamlined payment processes, boosted cash flow, and made a real impact on their business.

36% |

3,000 |

40,000+ |

| Average reduction in Days Sales Outstanding (DSO) | Number of B2B companies interviewed before build | Number of users that trust Bill360 with their AR automation |

Maximize margin, minimize surcharging risk.

Surcharging gone wrong could result in hefty fines and potential blacklisting. Offer your clients surcharging that automatically adjusts based on seller and buyer locations to comply with rules, regulations, and laws.

Frequently asked questions

First, they meet with an AR automation expert to see Bill360’s platform in action. Second, they submit business related information and documents to set up their merchant account. Third, their dedicated Customer Success Manager helps connect and sync their QuickBooks® or Xero® account and get the most value from our platform.

That’s it! In one day your clients could be sending invoices with built-in automations and embedded digital payment options, helping to optimize their operations and accelerate their cash flow.

We believe in partnership. As your clients sign up for and use Bill360’s platform the payments revenue is split. We win when you win!

Bill360 is a full-service payment facilitator (payfac). We operate in a highly regulated environment and follow stringent industry security standards including PCI DDS v4 accredited by a certified third-party auditor and yearly security audits with Fiserv®, a Fortune 500 company and global leader in payments and financial technology. All data on our platform is encrypted and payment information is also tokenized.

As a Third-Party Sender for ACH payments, we proactively comply with our ODFI’s and Nacha’s operating rules and requirements to ensure each payment is complete, accurate, and financially compliant.

No! Our platform automatically syncs to their QuickBooks® (desktop or online) or Xero® account.

Profiting off held funds is a dirty little secret common in B2B payments. Most B2B payment processors will hold larger transactions, further delaying your clients’ payments - negatively impacting cash flow - to take advantage of the deposit volume.

It’s common to see larger, repeat transaction in the B2B space. We made the decision early on to not hold large transactions whenever possible so our users can get paid faster. We can because we are a full-service payment facilitator (payfac) and have total control over payment schedules.

We’ll work with your sales and marketing teams to utilize co-branded landing pages, client-facing promotional materials, proven campaign tactics, and more. These materials and strategies are designed to make it faster and easier for you to highlight benefits and drive adoption.

We’ll work with your marketing team to develop offers and promotions that resonate and drive adoption with your clients.

As a partner you’ll receive a dedicated Partner Success Manager and your clients will each be assigned to a member of our Customer Success Team. These B2B experts are here to help you and your clients take full advantage of Bill360’s platform and services.

Our live, U.S.-based technical support team can also be reached at (888) 959-9891 Monday through Friday from 8:00 AM to 6:00 PM EST.

Becoming a full-service payment facilitator (payfac) is a long, difficult process achieved today by only four U.S.-based AR automation platforms serving small- to medium-sized B2B companies. The strict rules, governances, and codes of conduct set by Mastercard® and Visa® mean only the most trusted, credible, and experienced companies can become payfacs.

As a full-service payfac, we cut out the middleman when it comes to merchant account approvals, fee terms, and payment schedules. This means we can get your clients onboarded and paid faster, often reducing how much they are spending on processing fees.