The B2B AR automation company.

Headquartered in Tampa with an office in Jacksonville, Bill360 was created in 2021 to help small-to-medium B2B companies spur growth by automating their AR (accounts receivable) process.

At Bill360, we are revolutionizing AR automation by bringing the simplicity of the B2C payment experience to a B2B platform, helping our customers get paid faster, save time, and achieve long-term success. We improve the invoice-to-cash process through automated payment-ready invoicing, seamless embedded payments, valuable business insights, robust collaboration, and more.

2001: Sterling Payment Technologies (SPT) is founded by the future creators of Bill360 and introduces payment links on invoices, buyer portals, and accounting platforms for B2B payment data.

2017: SPT is acquired by EVO Payments. It remains renowned for its innovation, service, and support.

2021: After three years and nearly 3,000 interviews with key personnel from B2B companies, the leadership team behind SPT launches Bill360, the first SaaS-based, embedded platform that does it all – smart invoicing, payment reconciliation, and payment processing – for B2B companies.

Bill360 is already just one of approximately 200 U.S.-based companies registered and recognized as a full-risk payment facilitator (PayFac) by Mastercard and Visa, enabling us to practically eliminate withheld funds for our customers.

Becoming a PayFac isn’t easy and involves a strict application process. This achievement is a testament to the credibility and experience of Bill360’s leadership team.

To ensure the highest level of security, Bill360 operates in a regulated environment and adheres to stringent industry standards, including PCI DSS compliance. Bill360 is annually certified for PCI DSS v3.2.1 compliance by an accredited third-party auditor, ensuring our continuous alignment with the latest security protocols.

Bill360 also undergoes yearly audits conducted by Fiserv and complies with Nacha regulations and the operational requirements of our ODFI, ensuring that our ACH transactions are processed securely and in full compliance with all applicable standards.

What makes Bill360 different?

Unlike competitors that often adapt systems built for consumer (B2C) payments, Bill360 was built specifically to help B2B companies enhance their invoicing and payment processes. Here's what sets us apart:

- All-in-One B2B Solution: Our platform combines AR automation and payment control into one secure, easy-to-use platform that enables you to manage everything in one place.

- Goes Beyond Basic Accounting: Bill360 offers advanced features and reporting that accelerate cash flow and make it easy to manage.

- Smart Payment Engine: Bill360's payment system connects with various data sources and simplifies the payment process, accelerates collections, and gives you more control over invoicing.

- Built for B2B, Not Adapted from B2C: Many competitor systems are based on B2C technology, which can put B2B companies at a disadvantage. Bill360, on the other hand, was developed over four years with a $50 million investment, interviewing thousands of B2B companies to address their specific needs.

Bill360 has revolutionized B2B invoicing and payments by offering a truly tailored solution that significantly improves cash flow and control for businesses. Schedule a demo today and see our platform in action

This benefits of Bill360 include:

Quick Setup: Start using Bill360 the same day it’s implemented.

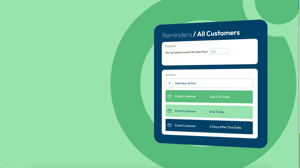

Advanced Automation: Enjoy enhanced features like automatic payments, reconciliation, invoice emails embedded with “Pay Now” links, and real-time reporting.

Real-time Collaboration: Address customer concerns immediately, resulting in faster payments and stronger cash flow.

Unmatched Customer Support: Access experienced customer success teams and live, U.S.-based client support for both AR automation and payments.

Get Paid in Full: Bill360's unique technology ensures large payments go through seamlessly, avoiding the common holds experienced with other systems.

Fast Buyer Adoption: Onboard your customers with ease, ensuring you and they get the most from the Bill360 experience.

Meet our executive leadership team.

Our executive team is comprised of fintech professionals who have significantly impacted some of the largest companies in the payment industry, including Bank of America, Chase Paymentech, Wells Fargo, First Data, Fiserv, and EVO Payments.